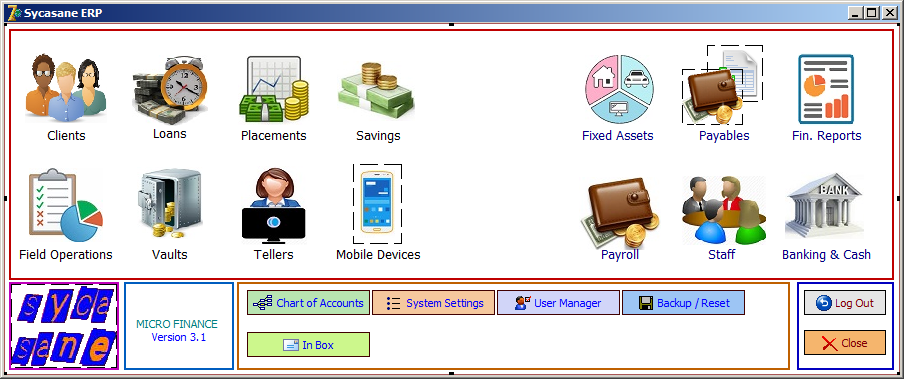

Sycasane Microfinance is an enterprise grade software suite for the management of microfinance operations.

There are lots of software everywhere, but the question is how efficient is your software working for you? How secured are your records? How easily can you share your application record over a network or to your other branches? How much support service are you getting from your software vendor? How easy and dynamic is your software to use? And how perfectly customized to your exact organization need is your software? These are a few of the unique services that stands us out in providing your software needs.

Sycasane Microfinance Modules includes:

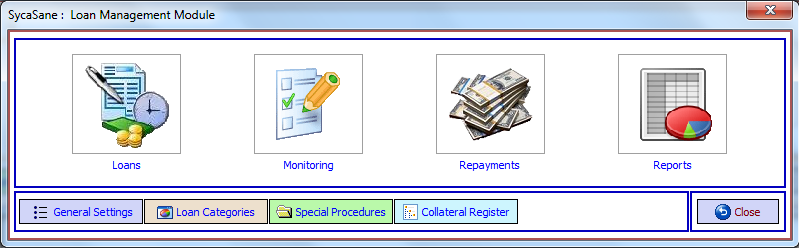

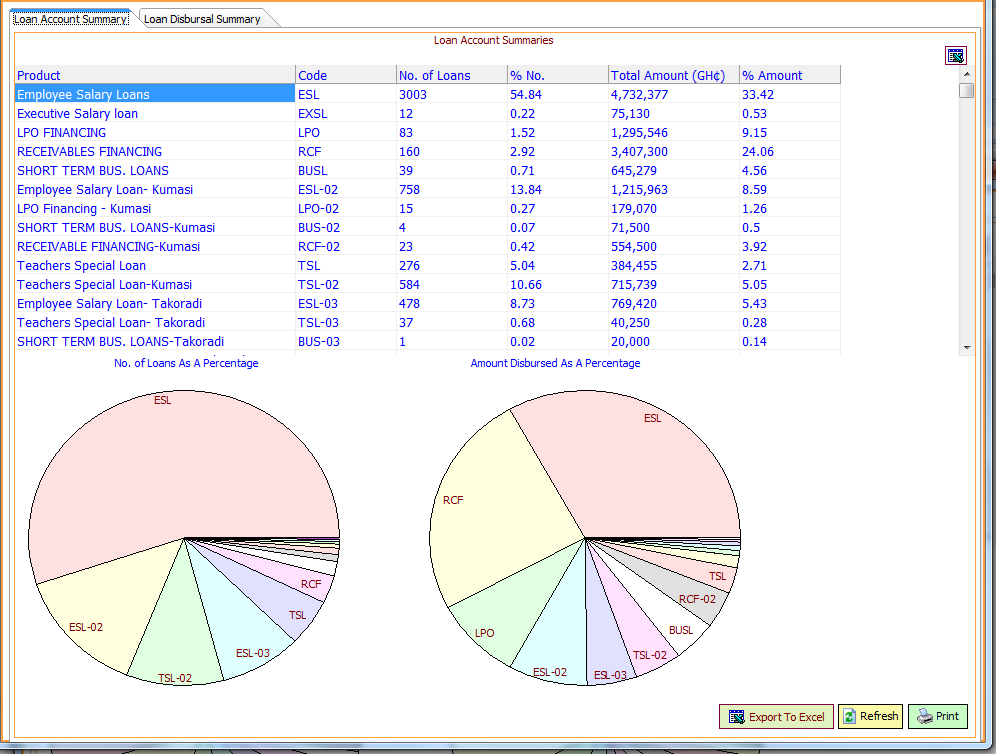

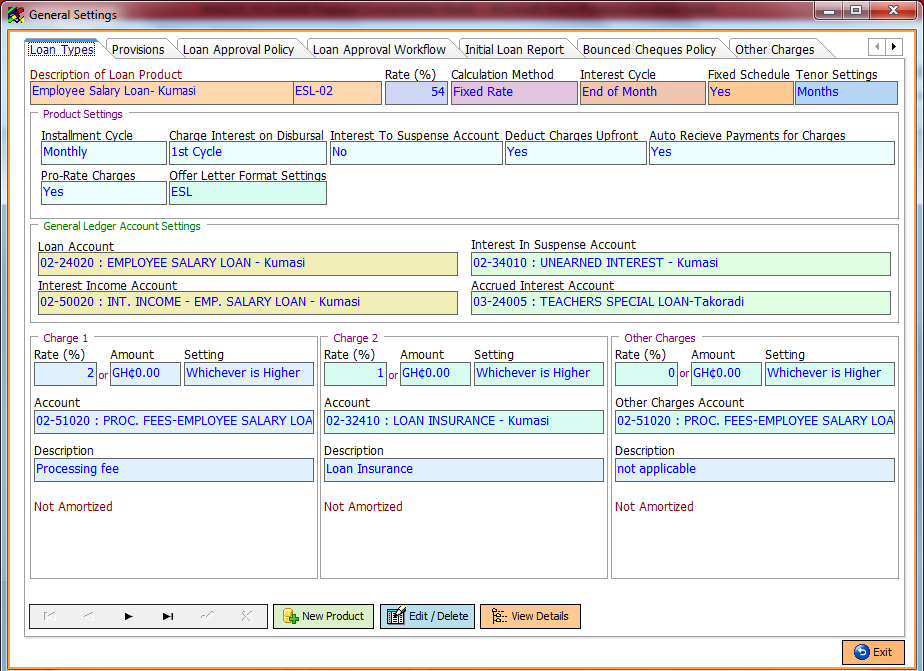

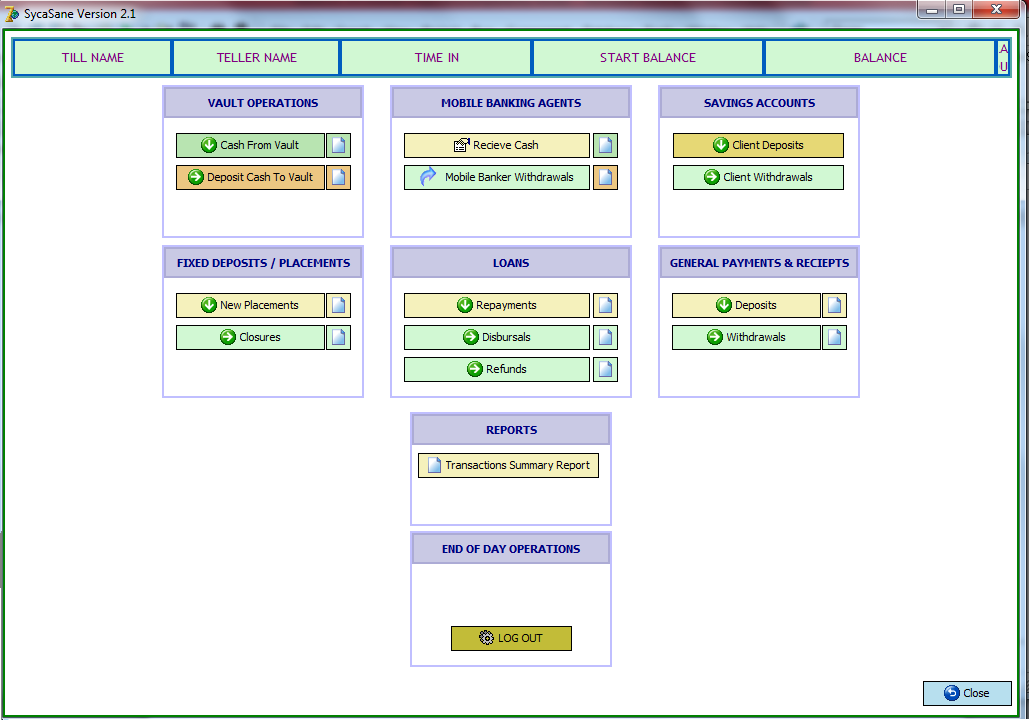

1. Loans Management Module

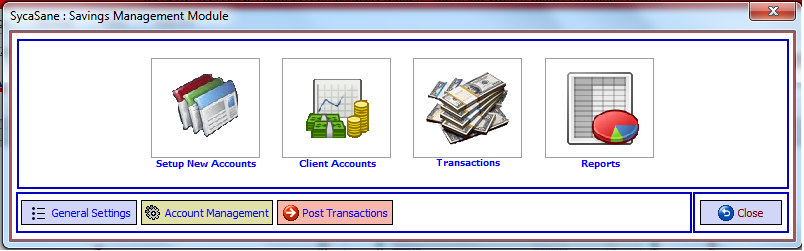

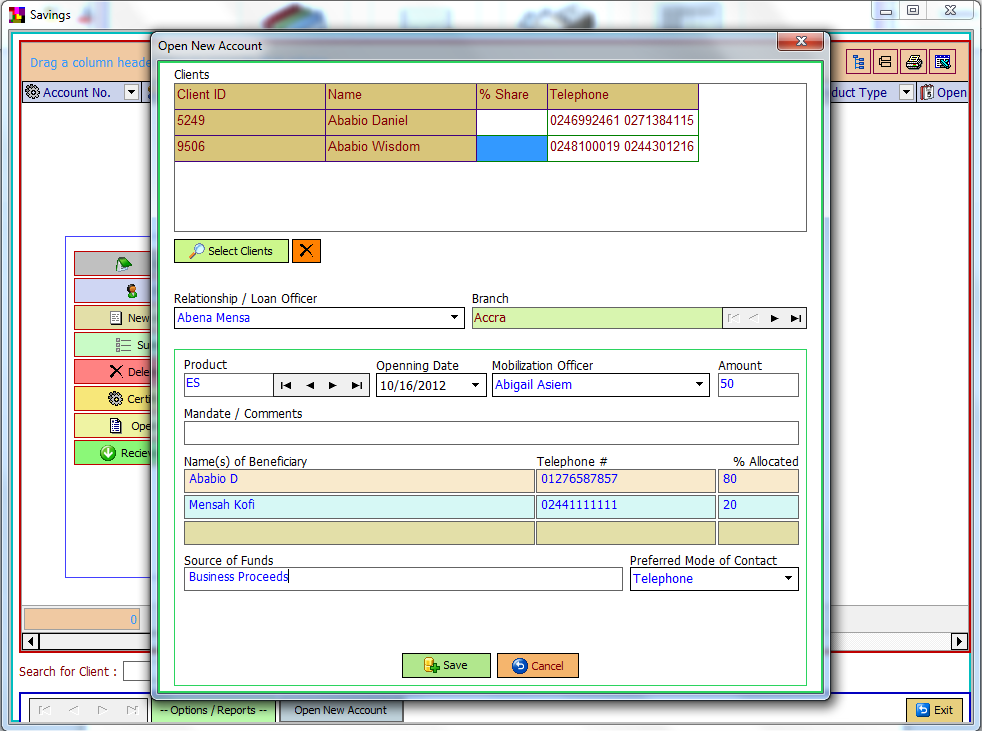

2. Savings Management Module

3. Time Deposits Management Module

4. Customer Relationship Management (CRM) Module

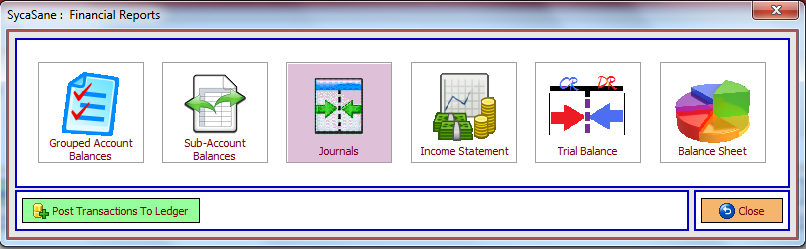

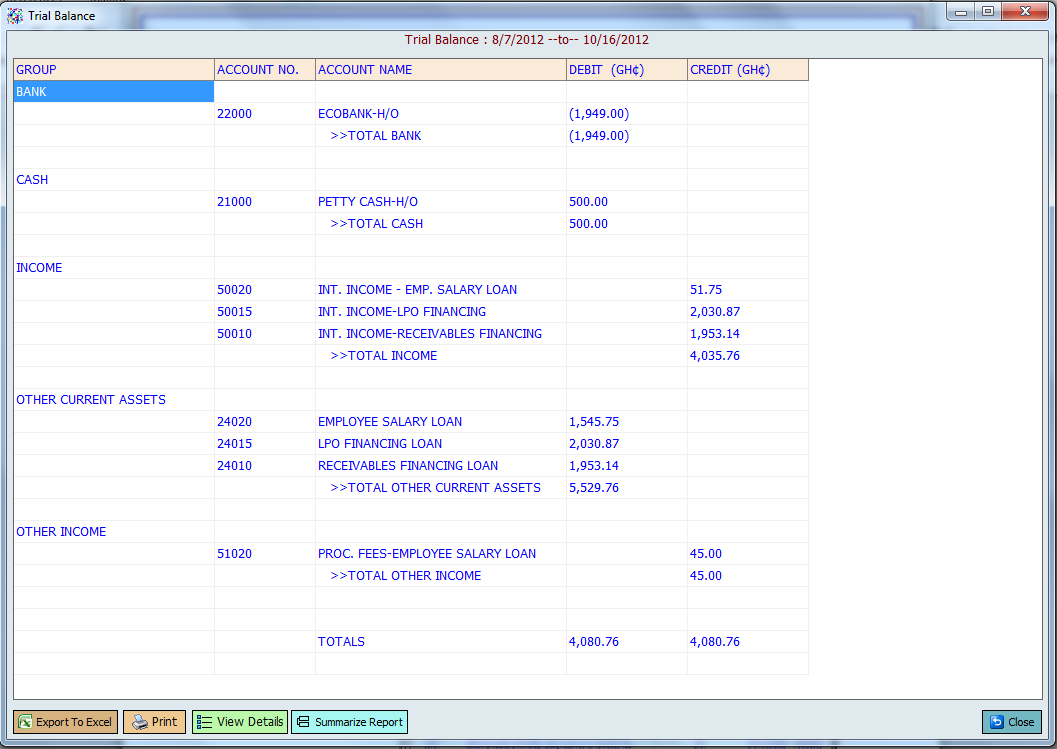

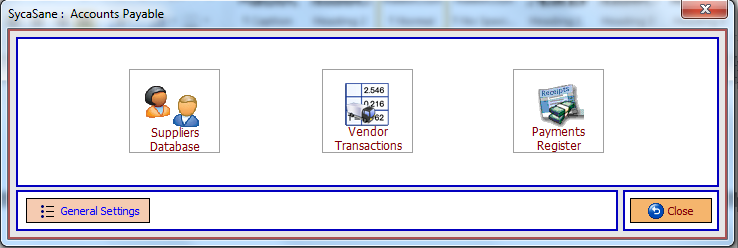

5. Accounting Module (Accounts Payable, Banking and Cash, Fixed Assets, General Ledger, Financial Reports)

6. Staff Management and Payroll Module

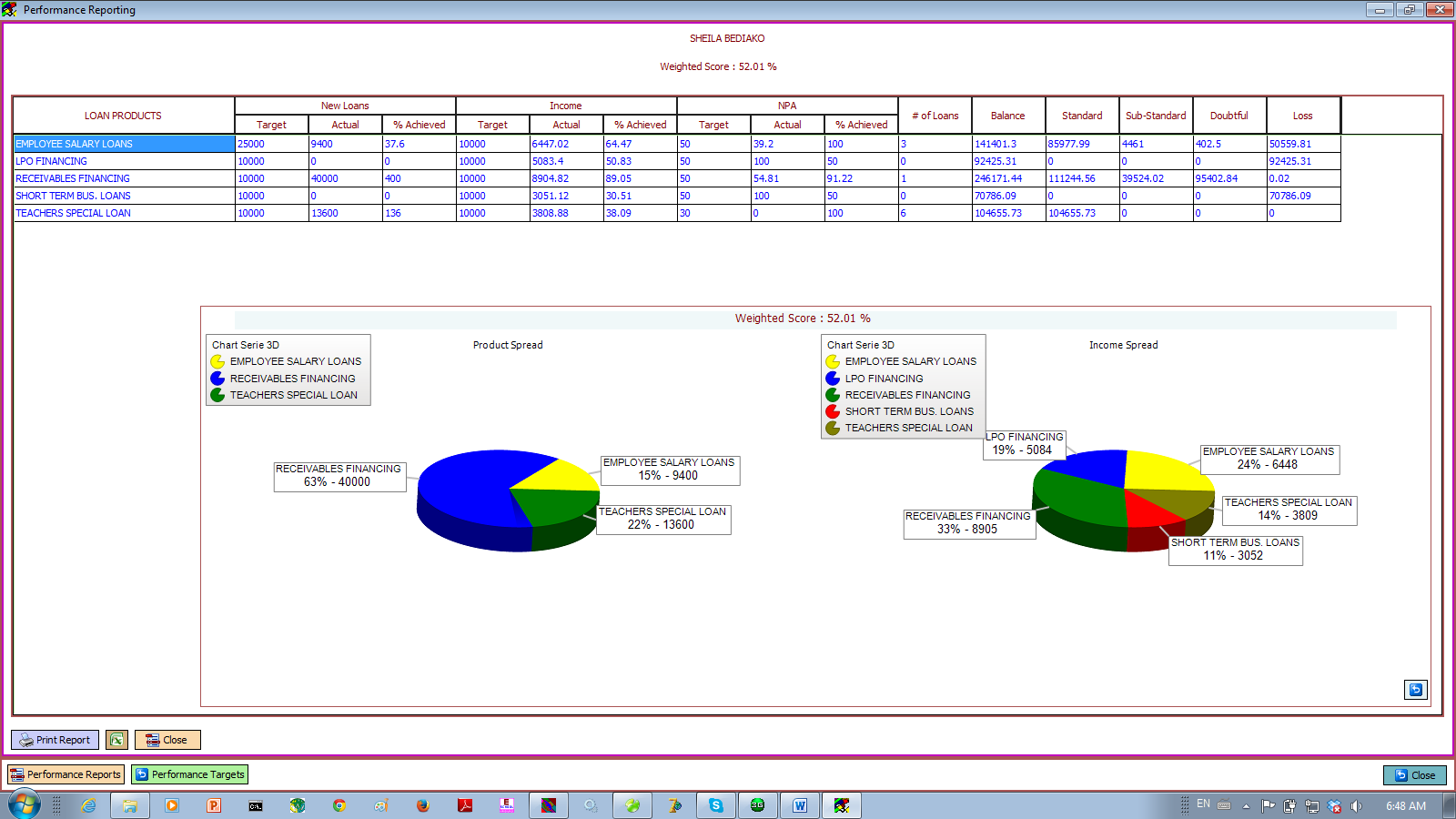

7. Team / Performance Management

8. Integrated User Management and Security

9. Audit Trail and User Activity Logging

10. Multiple Branch with Consolidated Reporting

11. Communication (Integrated SMS and Emailing)

12. Over 100 Industry Standard and Useful Reports

13. BOG Credit Bureau Reporting

14. Backup and Restore of Database

15. Network Capable (LAN / WAN / Internet)

16. Exporting of Reports To Various popular formats e.g. PDF, Word, Excel, HTML